Investment with The Symmetry Fund

Cryptocurrencies like Bitcoin, Ethereum, Ripple, Dash and Litecoin are disrupting how currencies are distributed and held every day. With cryptocurrencies still in the early stages of adoption, it can be difficult for people to understand how to obtain, hold, and trade these currencies on their own.

Growing interest from investors about cryptocurrencies is making the possibility of investing in a fund that trades cryptocurrencies extremely appealing. With the ability to invest at a variety of levels, securely store funds, and have input into how a cryptocurrency investment fund is managed, Symmetry Fund (SYMM) is offering investors the opportunity to gain exposure to the cryptocurrency market without the complexities of personally trading it themselves.

As in investor in SYMM, you will enter a managed fund that allows you to take part in the moves of the cryptocurrency exchange without the effort and significant capital investment that would otherwise be required when trading individually.

what is symmetry fund?

Part of the Ethereum (ETH) blockchain, SYMM is an ERC20-compliant smart contract. The fund pays monthly dividends in ETH.

A single share in the investment fund represents one SYMM token. The investment fund trades and invests in ICOs for cryptocurrencies including Bitcoin, Ethereum, Ripple, Dash and Litecoin. Shareholders will have the ability to trade their tokens with peers based on market rates. This will allow shareholders to cash-out as the fund value increases over time, in conjunction with receiving a monthly ETH dividend.

To ensure the whole fund isn’t exposed at any time, SYMM will always hold a percentage of funds in a prudent reserve. Further risk mitigation will also be provided by applying weighted currency and signal risks to each currency in the SYMM investment portfolio (BTC, ETH, XRP, DASH and LTC). When not in a trade, SYMM’s funds will be kept in fiat currencies (USD/EUR) so that the funds are not exposed to the volatility of blockchain assets. Keeping the fund’s exposure to blockchain assets to a minimum reduces the impact that large fluctuations in the value of cryptocurrencies may have on SYMM’s capital value.

To monitor the current reserves of the fund and the fund’s value, a self-certification system is included so shareholders can monitor their investment at any time. The fund’s self-certification will occur daily while monthly external audits will be conducted by the Big Four accounting firms. Performing daily selfcertification of funds in conjunction with monthly external audits will ensure transparency and trust between SYMM fund managers and shareholders.

Ensuring that investors will have input in the direction of SYMM is also an important part of the fund’s methodology and objectives. Shareholders will be able to vote on any decisions that affect the future direction of SYMM. Shareholder votes will occur on changes and developments such as proportion of the funds invested in ICOs and deciding which pairs will be traded.

token symmetry

1 SYMM = 0,1 ETH

- The ICO duration is 60 days from 30 November 2017 to 30 January 2018.

- ICO Soft Cap is 3,000 ETH.

- in the stage of pre-ICO, pre-sales and sale of the public, there will be no discounts are available.

- no hard cap for ICO.

- 10% of the funds will be stored in the backup to ensure that the overall fund has never been exposed at any time.

- 20% of the funds will invest in the ICO high potential. Symm will get discounts in (to 50%) of the ICO that have not been released for general sales.

- management costs will not be charged if there is no advantage.

- Funds held by SYMM will be subject to an external audit each month.

- 50% monthly trading profit will be paid in dividend to ET to investor every month and 50% monthly trading profit will be held for compounding growth.

- To reduce risk and ensure the stability of the value of funds, SYMM funds will be made in USD and EUR.

- Trading in BTC, LTC, DASH, ET and XRP will be made using 70% of the fund’s capital.

- Under the scenario of symmetry and projected funds, the estimated annual ROI for investors of SYMM is estimated at more than 50%.

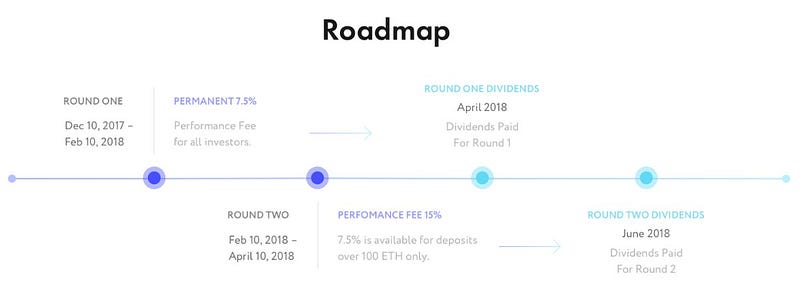

ROADMAP

TEAM

ADVISER

Tidak ada komentar:

Posting Komentar